Table of Contents

What you gonna find:

- SEC and CFTC leadership reshuffled to favour digital asset regulation.

- Strategic Bitcoin Reserve created, but without new BTC purchases.

- WLFI stablecoin launch triggered calls for an ethics investigation.

A President With His Own Memecoin? Trump's First 100 Days Redefine Crypto Politics

Donald Trump's first 100 days in office marked an unprecedented convergence of political power and cryptocurrency—so turbulent they've been labeled "the worst 95 days in modern presidential history" by former White House communications director Anthony Scaramucci. From audacious promises like a "Strategic Bitcoin Reserve" to explicit conflicts of interest involving World Liberty Financial (WLFI), the Trump family's crypto project, this initial period saw volatile market reactions, ethical debates, and deeply impactful moves on the cryptocurrency industry.

Investors watched prices fluctuate sharply as Trump's aggressive economic policies took effect, while Washington welcomed crypto-friendly regulators. Critics, however, raised alarms about ethical boundaries, arguing the president’s close ties to blockchain projects threaten institutional trust.

Jan 20 — The 100 Days Begin with a Presidential Memecoin

On inauguration day, Trump's family launched the second token sale of WLFI tokens, raising approximately $250 million. Despite initial enthusiasm, WLFI tokens remained non-tradable on exchanges, fueling skepticism about their real value. Trump's direct involvement triggered ethical concerns, marking a historic moment where a sitting U.S. president publicly supported his own digital asset, raising alarms about potential conflicts of interest.

Jan 20 — Crypto Allies Take Control on "Day One"

Trump immediately reshaped key financial regulators, appointing crypto-friendly figures like Paul Atkins to head the SEC, David Sacks as crypto and AI "czar," and Brian Quintenz to the CFTC. These moves signaled a dramatic shift from the previous administration, hinting at easier regulatory conditions, yet raising concerns about oversight on potential systemic risks.

Jan 21 — $500 Billion "Stargate" AI and Tech Infrastructure

Trump unveiled the "Stargate" AI initiative backed by giants like OpenAI and SoftBank, intended to create 10,000 U.S. jobs. While primarily focused on AI, the project's synergy with blockchain was clear, signaling the administration's broader commitment to technological dominance. Yet, congressional critics quickly questioned Trump's proximity to private tech investors.

Jan 21 — Presidential Pardon of Silk Road Founder

Trump commuted Ross Ulbricht's life sentence, pleasing libertarian-minded Bitcoin advocates. While hailed as a triumph for crypto freedom, critics argued Trump undermined judicial authority, raising tensions over governance and crime within digital currencies.

Jan 23 — Executive Ban on Digital Dollar, Promoting Crypto Leadership

Trump banned any U.S. Central Bank Digital Currency (CBDC) initiative, establishing a government task force to position the U.S. as a global crypto capital. Privacy advocates celebrated, though economic experts warned against forfeiting a strategic financial tool, potentially destabilizing monetary policy.

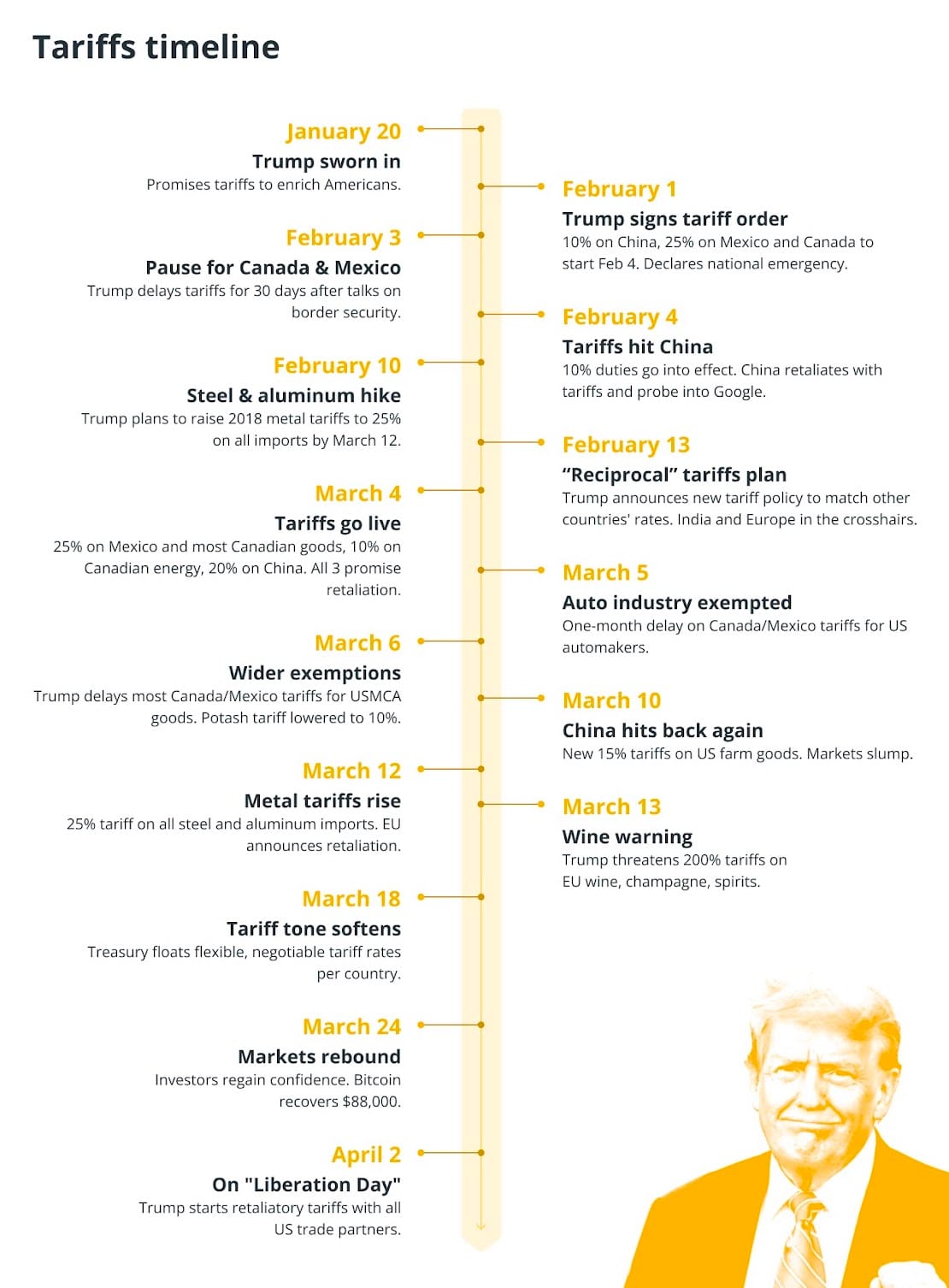

Feb 1 — Global Trade War Rocks Crypto and Traditional Markets

Trump imposed tariffs on Canada, Mexico, and China, sparking immediate market turmoil. Crypto assets, including Bitcoin, plummeted alongside stock markets amid fears of global recession, highlighting the sensitivity of crypto to macroeconomic events.

Feb 12 — Prisoner Swap Sends BTC-E's Vinnik to Russia

The U.S. exchanged notorious BTC-e exchange operator Alexander Vinnik, linked to massive Bitcoin laundering, for detained American teacher Marc Fogel. While politically beneficial, the deal alarmed cybersecurity authorities concerned about losing valuable intelligence on global cybercrime networks.

Feb 18 — SBF Makes Veiled Plea for Presidential Pardon

Sam Bankman-Fried publicly appealed to Trump, criticizing judicial handling of his fraud charges and suggesting political alignment. His overture sparked controversy, raising concerns of political favoritism influencing judicial outcomes.

Mar 7 — Strategic Bitcoin Reserve Underwhelms Enthusiasts

Trump’s executive order creating a U.S. Strategic Bitcoin Reserve merely consolidated government-seized Bitcoins without immediate purchases, disappointing Bitcoin maximalists expecting significant market impact. Nonetheless, recognizing Bitcoin as a strategic national asset set a landmark precedent.

Mar 7 — White House Crypto Summit Draws Mixed Reactions

Key crypto executives met at the White House, optimistic about regulatory clarity but facing criticism for lacking concrete legislative outcomes. Critics dismissed the summit as political theater, emphasizing the need for substantial congressional action.

Mar 25 — WLFI's Stablecoin Raises Congressional Ethics Concerns

WLFI launched USD1, a new stablecoin, prompting immediate congressional scrutiny for potential conflicts of interest. Critics argued Trump’s dual role as issuer and regulator posed significant ethical risks, fueling legislative urgency around stablecoin regulations.

Apr 2 — "Liberation Day": Worldwide Tariffs Ignite Economic Fears

Trump imposed sweeping reciprocal tariffs globally, dramatically affecting crypto mining operations due to increased equipment costs. Markets plunged, igniting recession fears, while Trump’s direct market commentary raised further conflict-of-interest alarms.

Apr 25 — $300,000 Memecoin Dinner Sparks Impeachment Calls

Top holders of Trump's $TRUMP token were reportedly invited to a $300,000-per-plate dinner with the president, triggering impeachment calls from opponents alleging blatant pay-for-access corruption. Despite denials, the controversy reinforced ethical concerns about presidential cryptocurrency involvement.

The First 100 Days: Crypto Revolution or Ethical Disaster?

Trump’s presidency dramatically accelerated crypto acceptance in Washington yet simultaneously exposed unprecedented ethical risks and conflicts of interest. Regulatory progress was overshadowed by political polarization, leaving critical stablecoin and crypto legislation uncertain. These first 100 days crystallized crypto’s geopolitical significance but raised profound questions about ethics, power, and financial governance.

For investors and enthusiasts alike, navigating crypto markets now means decoding presidential tweets alongside market charts—demonstrating just how deeply politics and digital assets have intertwined under Trump’s turbulent first months.